Global Oligopolies: What You Need To Know

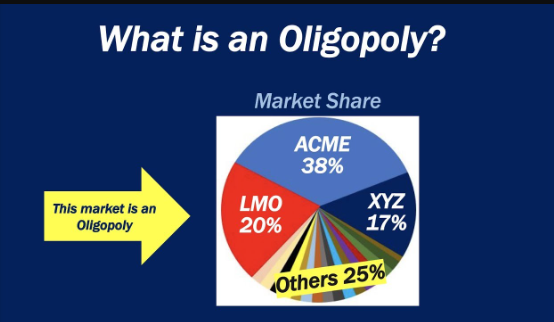

Global oligopolies are market structures dominated by a few large firms. These entities have significant control over prices and market share.

Oligopolies characterize industries where a handful of companies wield considerable influence. This market structure fosters an environment where competition is limited, shaping the dynamics of pricing, production, and strategic collaboration. Barriers to entry are typically high in oligopolistic markets, limiting the influx of new competitors.

The automotive, airline, and technology sectors often display oligopolistic traits, as the leading companies set industry standards and trends. Due to the limited number of alternatives, consumer choice can be restricted under oligopolies. To capture and maintain market share, corporate strategies frequently include non-price competitions, such as advertising and product innovation. Understanding oligopolies is vital for stakeholders to navigate the competitive landscape and for regulators aiming to maintain fair market practices.

Contents

The Concept Of Global Oligopolies

Global oligopolies define markets controlled by a few firms. These giants often share market power, influencing prices and competition. Oligopolistic markets significantly impact global trade and economic trends. Dominance in technology, manufacturing, and branding is common among these corporations. Factors like research and development capabilities usually set them apart.

The evolution of global oligopolies is tied to advancements in technology and globalization. Early industrial-age success stories paved the way for modern conglomerates. Access to international markets and supply chains accelerated their growth. Major players thrived, influencing economic policies and shaping industry standards.

| Characteristic | Description |

| Market Control | Limited firms dominate |

| Influence on Prices | Power to set market prices |

| Barriers to Entry | High costs deter newcomers |

| Global Reach | Presence in multiple countries |

Major Industries Dominated By Oligopolies

The tech industry is a clear example of an oligopoly. A few big companies control the market. These include names like Apple, Google, and Microsoft. This dominance allows for control over innovation and pricing.

Oil and Gas markets also show oligopoly traits. Companies such as ExxonMobil, Royal Dutch Shell, and BP lead globally. They influence oil prices and production significantly.

The automotive industry has dominant players like Toyota, Volkswagen, and Ford. These giants innovate while controlling market prices. They have a big say in global car trends.

Big Pharma, consisting of pharmaceutical giants, greatly impacts healthcare. Companies like Pfizer, Johnson & Johnson, and Roche steer medical research and drug costs and hold key patents on life-saving medications.

Economic Impacts Of Oligopolies

Oligopolies affect markets worldwide, influencing economics largely through their price-setting behaviours. Companies in an oligopoly can collude to set high prices, which often leads to higher profits for them but can mean higher costs for consumers.

Barriers to entry are also significant in oligopolistic markets. New companies need help to enter due to high start-up costs, established brand loyalty, and control over resources by existing firms.

Innovation and research can thrive in such markets as companies strive to outdo competition. This results in advanced products but can also increase prices due to patenting and technology development costs.

The limitation on consumer choice is a downside of oligopolies. With fewer firms, consumers have limited options to choose from. This can affect overall market satisfaction and welfare.

Market Strategies In Oligopolistic Firms

Oligopolistic firms often follow unique market strategies. These firms shape markets globally. Collusive agreements among competitors can set prices or output. Such collusion can stabilize uncertain markets. Companies often avoid direct price wars by choosing non-price competition. This involves marketing, branding, and quality enhancements.

Businesses may also form strategic alliances. These alliances can provide mutual benefits without merging. They boost innovation and market reach. For a more profound impact, firms might pursue mergers and acquisitions. This consolidates market power and resources, which is crucial in maintaining a strong market presence.

Regulatory Challenges And Antitrust Laws

Global oligopolies pose significant regulatory challenges for governments worldwide. Antitrust laws, designed to prevent market dominance, are now facing trials against giant firms. Enforcement requires a balance, striving to maintain fair competition without stifling innovation.

Government interventions are often seen during high-profile legal battles between authorities and large corporations. These confrontations can lead to heavy fines and stricter regulations. The dynamics of global antitrust enforcement reflect the ongoing struggle to adapt to the rapid evolution of international markets.

Consumer protection remains at the heart of these efforts. Laws are updated to safeguard consumer interests and market integrity. However, the complexity of global operations can muddy legal waters, challenging existing frameworks and pushing for novel approaches to antitrust issues.

Global Politics And Oligopolies

Global politics is deeply intertwined with oligopolies. These large entities shape trade policies, influencing market access and competition. Due to the economic clout of these corporations, international relations can sway, often leading to negotiated outcomes that favour their interests.

Economic sanctions can be used against nations, but oligopolies might avoid them through their global presence. Their lobbying power also allows for significant sway over domestic and international policies, often affecting legislation and regulation to benefit their operations.

| Aspect | Influence |

| Trade Policies | Market access and competitive edge |

| International Relations | Negotiations benefiting oligopolies |

| Economic Sanctions | Potential avoidance by global entities |

| Lobbying Power | Legislation and policy influence |

Future Of Global Oligopolies

Emerging markets are reshaping global oligopolies. Their growing economies demand more power in global businesses. Countries like China and India are now big players. They set new rules for global markets.

Technology changes fast, and oligopolies must keep up. Innovations lead the way. Companies that can’t adapt fall behind. Leaders invest heavily in research and development.

Customers today want different things than before. They look for customization and experience. Oligopolies that understand this will continue to rule.

Sustainability is no longer optional. It’s necessary. Pressure comes from governments, people, and nature itself. Businesses that ignore this will only last for a while. The ones that embrace it will lead tomorrow’s market.

Case Studies

Tech Industry Titans are known for their massive influence. Companies like Apple, Google, and Facebook dominate the market. They control vast portions of the tech world. Their products reach billions, shaping tech trends.

Certain countries and corporations engage in cartel dynamics within the oil sector. They decide the supply of oil globally, which affects oil prices everywhere. The Organization of the Petroleum Exporting Countries (OPEC) is a prime example. They regularly meet to set production levels.

Big Pharma uses strategies to stay on top. They hold patents to keep control of drug markets. This often leads to high medicine prices. Companies like Pfizer and Merck are vital players.

Automotive giants like Toyota, Volkswagen, and Tesla lead the car manufacturing industry. They have a big say in automotive trends and technologies, and their power influences what cars we drive.

Conclusion

Understanding global oligopolies helps us grasp the complexities of modern markets. These powerhouses shape economies and influence consumer choices. By remaining informed, we empower ourselves to make smarter decisions as consumers and investors. Let’s continue the conversation and demystify the reach and impact of these market giants.